This is not a financial advice but let me share my experience with different investment assets…

Rental property: Most of my income comes from various living spaces. Two long term rentals, and a short term airBNB. The two long term rentals are in a metropolitan area, where many come to study and work, whereas short term airBNB is in a rural area. Property is a good investment but all depends on the location and type.

The government is very concerned about housing. And this can be good and bad. On one hand, you are viewed as an evil exploitative landlord, and the government will punish you with taxes and rent controls, but the government also supports tenants that struggle to pay the rent. This means that you will get money even in the darkest times like the Covid lockdown.

The Covid lockdowns have put a lot of people on home office, and many companies realized this is more profitable than maintaining an office in the downtown. Also home office workers take fewer sick days. They don’t care about that sneeze or cough, and will do some work. Naturally office space is struggling, commercial real estate is not experiencing its best days with all the online sales.

Real estate’s profitability is dependent on market forces. My airBNB is very seasonal, summer months bring the most revenue and winter months are rather poor. People come here for cycling and sightseeing. I opened the thing after Covid, Covid would have been shit. Governments are not keen on these short term rentals, I have to have a business licence and pay the municipality. Big cities might have even more regulations. But you can collect many times more money than from long term rentals.

I have mostly experience with residential. There are also things like agricultural land. Not all land is created equal, and the yields might vary. Real estate is a pretty stable form of income but it is prone to third party risk and cannot be moved to another jurisdiction. Population collapse, the die off of boomers, AI driven construction could cheapen properties, and this makes it an unstable storer of value. Inheritance tax is another thing that makes it impossible to build wealth over generations with property. Finally, selling a property might take months, it is highly illiquid.

Stocks: I was trying many jobs and for a time I was a financial advisor, that is a haughty title for a financial instrument peddler. I did not succeed but at least I learned about index funds, and later I learned on my own about ETFs, and I invest in both. I don’t know where this will take me. I want to have several millions of CZK worth of stocks. Stocks are very dependent on markets, they are prone to booms and busts. So when times are good, your portfolio grows, and when they suck, it falls.

Bonds: I keep very little money in bonds. In fact I have this index fund linked to this financial instrument that “invests spare change”. The fund is formed of mostly CZK denominated bonds and the yield is 6-8%. People consider government bonds to be a safe investment, after all the government prints the money. But safe does not mean profitable, the riskier the shit the greater the dividend usually. The dodgier the government, the higher the interest rate.

BTC: Around 2019, I watched this Czech YouTuber that explained Bitcoin. And I invested £100 into it. I am a messy person and lost my hardware wallet. But few years later I found it, and my investment of £100 was now £500. I decided this year to invest regularly into BTC. BTC has a fixed supply, and seems like a good storer of value. Some people say it is going to the moon. Some are afraid that it is prone to hacking with the help of AI. I don’t have the knowledge to judge any of these claims. I put money that I do not immediately need into it and let the fate work its way.

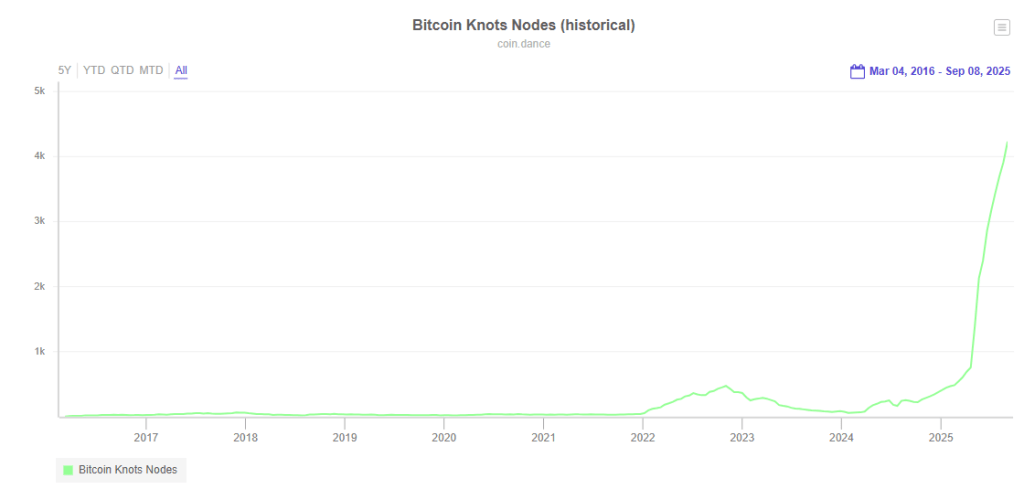

I am a BTC maximalist, all other cryptocurrencies are shit coins, so if you want to invest in whatever, only BTC. BTC does not have a known founder, nobody has ever seen Satoshi Nakamoto; everybody has seen Vitalik Buterin. The BTC protocol is fixed, nobody can temper with it. The supply is fixed, unlike with ETH or whatever other cryptocurrency. Besides, there is no need for another cryptocurrency.

Another thing is liquidity. This is the most liquid asset out there in my opinion. It is traded all the time. Stocks depend on the exchanges they are traded at, gold also needs to be sold to buyers in person. You can cash in your BTC in an instant. Also BTC can be used as payment method, and it can be used as collateral for fiat loans. There are also credit cards that facilitate payments using BTC, and other cryptocurrencies.

Gold: In my opinion gold is the only precious metal worth investing into. Gold is scarce, and it does not rust. Silver depreciates under the elements, and is much more abundant. Unlike silver, the government does not tax gold purchases here in Czechia. Gold has an inflation rate of 2% annually (in 1941 it was 4%, wonder why). And I am fearing that at one point, somebody might find an asteroid full of gold and knock the price down. Maybe at that point I would buy some gold bars. But I missed my chance and now gold is at all time high.

Because gold is tangible some think it is better than BTC. But its tangibility is a liability. My house got broken into once, and while I have a safe box downstairs deep in the basement to store things like that, I am still not very satisfied. The liquidity of gold is dependent on a service of gold vendors that would send a van and pick up your bars, otherwise you have to drive yourself to a vendor or exchange. If you are an institution, with facilities to store your treasure, go ahead but I am a small time retail investor. You can also keep your gold with a third party custodian, much like I do with stocks. Again, this is about a service, and what suits you. But they take a commission.

Ultimately, I invest in whatever I imagine is good at the moment, and I invest whatever money I imagine I can invest. I walk through this life and create different streams of income because my ass is Jupiter-Uranus conjunction in the second. And my opinion on them shifts all the time as my knowledge increases…